Expand Your Firm Faster With Advice From Succentrix Business Advisors

Expand Your Firm Faster With Advice From Succentrix Business Advisors

Blog Article

The Advantages of Employing a Specialist Organization Accounting Consultant

Engaging a professional service audit expert can be a transformative choice for any kind of organization. These experts not just bring a riches of competence in financial management however additionally enhance functional effectiveness and calculated planning. By leveraging their insights, businesses can browse complicated governing landscapes and decrease tax liabilities, consequently cultivating sustainable development. The benefits prolong past simple conformity and effectiveness; there are deeper ramifications for long-lasting success that quality expedition. What particular approaches can these experts implement to tailor financial options that align with your company objectives?

Knowledge in Financial Management

In addition, a skilled consultant can carry out robust bookkeeping systems that supply accurate and prompt economic details. This accuracy is vital for keeping an eye on efficiency and making educated decisions. By leveraging their know-how, companies can enhance their economic literacy, enabling them to translate economic reports and comprehend the implications of various monetary methods.

Moreover, the expert's understanding right into regulatory compliance makes sure that organizations comply with financial laws and standards, reducing the risk of expensive charges. They likewise play a crucial role in tax obligation preparation, aiding to minimize obligations and make best use of cost savings. Ultimately, the calculated guidance and monetary acumen given by an expert business accountancy advisor empower companies to achieve sustainable growth and maintain a competitive side in their respective markets.

Time Savings and Performance

Lots of businesses discover that partnering with an expert company accountancy advisor results in considerable time cost savings and enhanced functional efficiency. By entrusting economic obligations to a specialist, business can redirect their emphasis towards core tasks that drive development and innovation. This delegation of tasks allows entrepreneur and supervisors to concentrate on strategic efforts as opposed to obtaining stalled by day-to-day accountancy features.

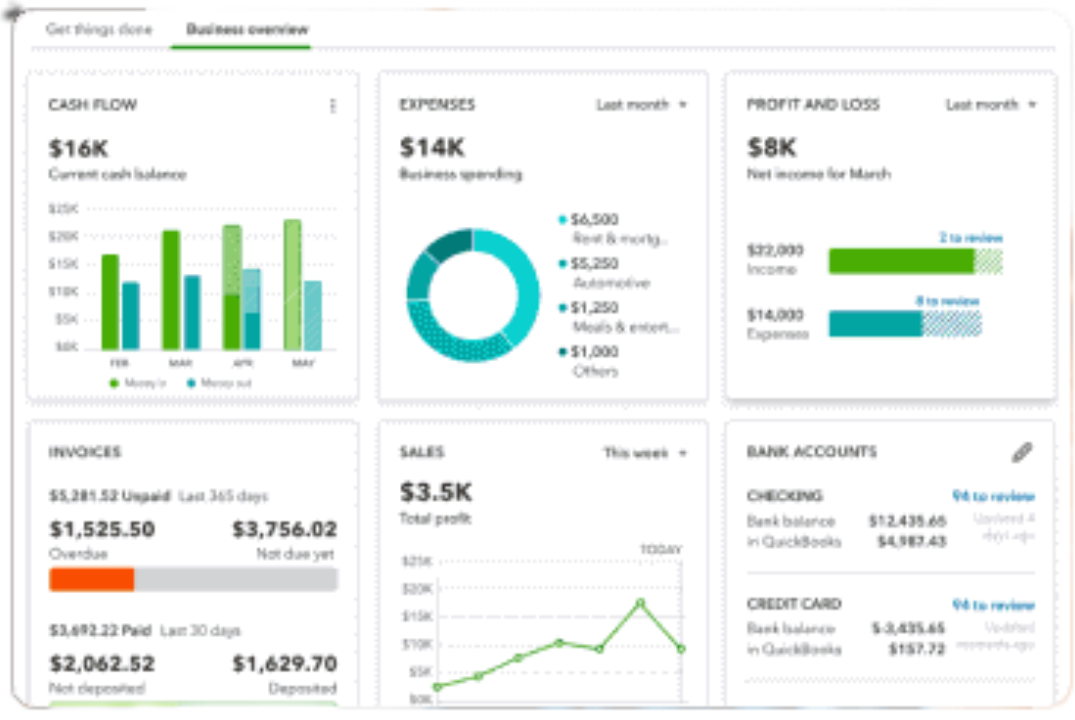

Professional experts bring streamlined processes and progressed software application services to the table, considerably lowering the moment invested in accounting, tax preparation, and conformity. They are experienced at determining inefficiencies and carrying out best methods that not just save time however also reduce the danger of errors. Moreover, their expertise makes certain that target dates are satisfied regularly, preventing final scrambles that can impede performance.

With a professional audit expert handling financial matters, services can avoid the tension of keeping accurate records and navigating intricate policies. This effectiveness fosters a more well organized and positive strategy to monetary monitoring, eventually adding to better resource allocation and boosted overall performance. Succentrix Business Advisors. This way, hiring an audit advisor not only saves time however likewise enhances the performance of service procedures

Strategic Planning and Insights

An expert company accounting consultant plays a critical role in critical preparation by offering valuable understandings derived from comprehensive financial analysis. Their know-how makes it possible for organizations to understand their monetary landscape, identify development opportunities, and make notified decisions that align with their lasting purposes.

Furthermore, accounting experts can aid in scenario preparation, examining possible outcomes of different critical campaigns. This insight outfits service leaders with the knowledge to browse uncertainties and capitalize on beneficial problems. By integrating financial information right into the strategic preparation procedure, consultants equip organizations to craft durable service versions that boost competitiveness.

Ultimately, the cooperation with a specialist audit consultant not just elevates the critical planning procedure but also fosters a society of data-driven decision-making, positioning organizations for continual success in a significantly vibrant marketplace.

Conformity and Threat Mitigation

Compliance with economic policies and efficient danger reduction are essential for organizations intending to keep operational stability and secure their assets. Working with a professional business accountancy consultant can substantially boost a firm's capability to browse the complex landscape of financial conformity. These experts are skilled in the most recent governing needs, guaranteeing that business complies with local, state, and federal legislations, therefore reducing the threat of legal challenges or pricey penalties.

Furthermore, a specialist advisor can determine potential dangers linked with financial methods and recommend strategies to mitigate them. This aggressive strategy not just safeguards business from unanticipated liabilities however additionally promotes a society of liability and transparency. By frequently conducting audits and analyses, they can discover vulnerabilities in monetary processes and carry out controls to resolve them efficiently.

Along with conformity and danger monitoring, these experts can supply valuable insights into finest methods that line up with industry criteria. As laws remain to develop, having a devoted accountancy expert makes sure that organizations continue to be dexterous and responsive, enabling them to focus on development and innovation while securing their monetary health and wellness.

Customized Financial Solutions

How can organizations enhance their financial techniques to meet distinct functional requirements? The response exists in using an expert service audit expert who specializes in tailored financial options. These professionals assess the certain challenges and objectives of a company, allowing them to establish tailored techniques that straighten with resource the company's vision.

Customized economic remedies encompass a variety of solutions, consisting of capital monitoring, tax obligation budgeting, forecasting, and preparation. By examining present economic information and market problems, consultants can develop bespoke strategies that make the most of earnings while decreasing risks. This personalized technique ensures that services are not merely following common financial techniques but are instead leveraging methods that are especially made to support their operational characteristics.

Furthermore, customized solutions permit versatility; as organization needs evolve, so also can the monetary strategies. Succentrix Business Advisors. Advisors can frequently assess and readjust strategies to reflect modifications on the market, governing setting, or business objectives. Eventually, the assistance of an expert accountancy consultant allows companies to navigate complexities with self-confidence, making sure sustainable growth and monetary health tailored to their distinctive demands

Conclusion

In final thought, the advantages of employing a specialist company audit consultant are extensive and diverse. Their efficiency in compliance and threat reduction additionally safeguards companies from regulative pitfalls while optimizing tax responsibilities.

A specialist organization bookkeeping consultant brings a wealth of expertise in financial evaluation, budgeting, and strategic planning, which are crucial parts for sound economic decision-making. By leveraging their know-how, companies can enhance their monetary literacy, enabling them to moved here analyze economic records and comprehend the effects of numerous economic techniques.

Ultimately, the critical advice and economic acumen supplied by an expert company accounting expert encourage organizations to attain sustainable development and preserve an affordable side in their respective markets.

Many services locate that partnering with a professional business audit consultant leads to significant time cost savings and enhanced functional efficiency. Inevitably, site link the advice of a specialist audit advisor makes it possible for companies to browse complexities with self-confidence, making sure lasting growth and economic health customized to their distinct requirements.

Report this page